The next wave of digitization is reaching an inflection point

For more than a decade, powerful new digital approaches to business, have come on the scene.

Netflix launched in 1999, and a decade later Blockbuster had to shut its doors, forced out by online streaming platforms.

Business is now entering an even more rapid and dramatic period of change

Uber that was founded in 2009, and has come a long way since. In its latest funding round, Uber was valued between $60 billion and $70 billion. At $70 billion, Uber would pass the market value of GM, Honda and Ford.

But business is now entering an even more rapid and dramatic period of change. The phenomenon of digitization is reaching an inflection point. Three powerful forces are driving the shift: consumer demand, the push for new technologies, and the prospect of even greater economic benefits.

The effects of an increasingly digitized world are now reaching into the freight industry

Online business-to-business sales (B2B) grow every day, outpacing the growth pace of online (B2C) business-to-consumer sales. But while many B2B industries continue to expand sales online, the logistics industry has been slow to adopt online freight sales and booking.

But now investors are funding dozens of startups with plans to take the low-tech business of arranging cargo shipments online.

Technology is changing. Shipper expectations are changing. And forwarder capabilities are changing

Venture capital firms have already invested more than $1 billion into startup freight-forwarding companies. Considering this industry from a techie standpoint wasn’t on anyone’s radar, that’s pretty impressive and worth tracking as time goes on.

Growing demand for transparent logistics, changing industry mindsets, big data-technology, flexible supply chains, and growing demand for cross-border e-commerce is changing freight to go online. And it’s coming from the freight companies, it’s coming from huge tech companies, and it’s coming from an exploding number of startups.

The “Uber-for-Trucks” business model is taking off

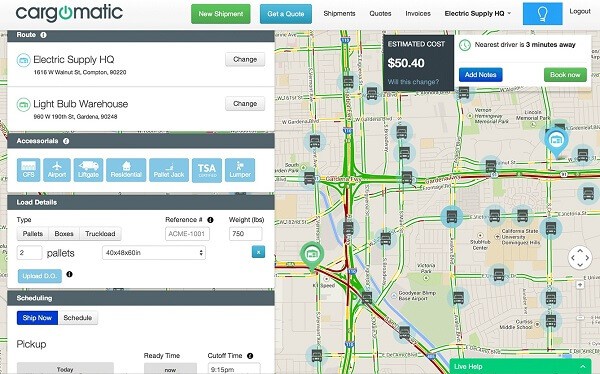

Convoy, a Seattle-based company that presents itself as “Uber for trucking,” have launched an online service and app pairs shippers with available local carriers based on proper equipment, payload, capacity, and distance. Convoy gives pre-approved carriers the option to accept or decline a job based on the listed price, which eliminates haggling – a hallmark of the trucking business.

Los Angeles-based Cargomatic, also hopes to become “Uber for truckers” by providing a platform enabling shippers to list available jobs that local truckers with excess capacity can complete. By making the connection, the company hopes to not only help truckers make more money, but also to route shipping more efficiently.

Transfix, Trucker Path, Cargo Chief, Quicargo, and others are also in the race.

The “Uber of ocean transportation movements”

San Francisco-based Flexport wants to become the Uber of ocean transportation movements. It is a licensed customs brokerage and freight forwarder built around an online dashboard. Services include air freight, ocean freight, trucking, fulfillment and cargo insurance. By automating its services and delivering them through an online dashboard, the company is able to reduce costs and improve reliability.

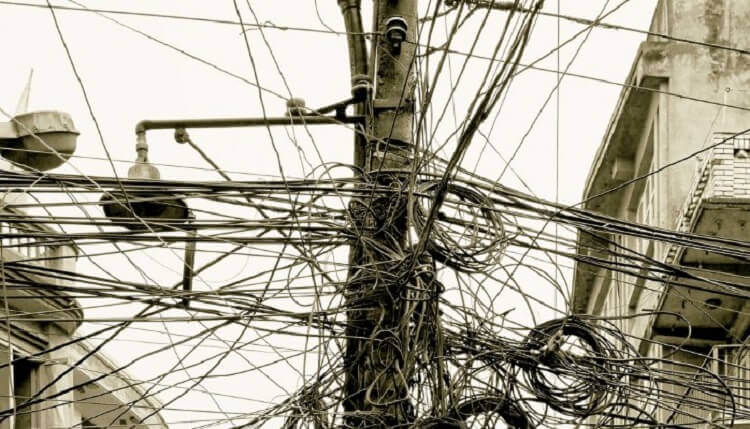

Getting stuff from point A to point B should be straightforward. For companies that need international cargo shipping, however, the process often turns into a labyrinthine tangle of phone calls, faxes, and emails to third-party service providers with different pricing models and ways of sharing data. A new startup called Haven wants to simplify things. Haven gives shippers an online platform to compare and reserve container slots from 10 ocean carriers.

Tel Aviv, Israel-based Freightos – compare real-time quotes and book international freight instantly. Easier said than done, but Freightos is giving it a serious try.

Even the Boston Consulting Group is testing the waters launching xChange, a marketplace for empty shipping containers. The platform provide end-to-end functionality and enable the direct exchange of containers and other equipment between market participants, such as container liners and other logistics companies.

The incumbents

Air, ocean, and trucking leaders are also onboard. The world’s biggest ocean freight forwarder, Kuehne+Nagel, are revamping technology to enable online booking for less-than-container load (LCL) shipping.

Obtaining quotes and placing bookings is often a time-consuming process that may cause delays. Using KN FreightNet for LCL, customers can obtain quotes for export and import shipments online within seconds and are able to place their orders faster than ever.

It’s happening across the industry

The same is true with Flexe’s “Airbnb for warehouse space”. A startup that links businesses to other businesses that have extra warehouse storage space to rent out.

Short URL & Title:

The next wave of digitization – Rapid period of change — https://www.torbenrick.eu/t/r/dvi

Share it:

If you enjoyed this article, please take 5 seconds to share it on your social network. Thanks!

About The Author

Torben Rick

Experienced senior executive, both at a strategic and operational level, with strong track record in developing, driving and managing business improvement, development and change management. International experience from management positions in Denmark, Germany, Switzerland and United Kingdom