Conflicting cultures is one of the bigger challenges of Mergers & Acquisitions

The role of organizational culture in mergers and acquisitions

When it comes to Mergers & Acquisitions (M&A), most due diligence focuses only on the financials. Later, management is usually shocked to find the degree of differences that exists between their two, soon to be merged, organizations. Conflicting cultures is one of the bigger challenges of M&A.

It’s surprising that so many companies still spend a large amount on legal due diligence, financial due diligence and ultimately the purchase price, and too often leave the most important asset in the deal – the organizational culture – to chance.

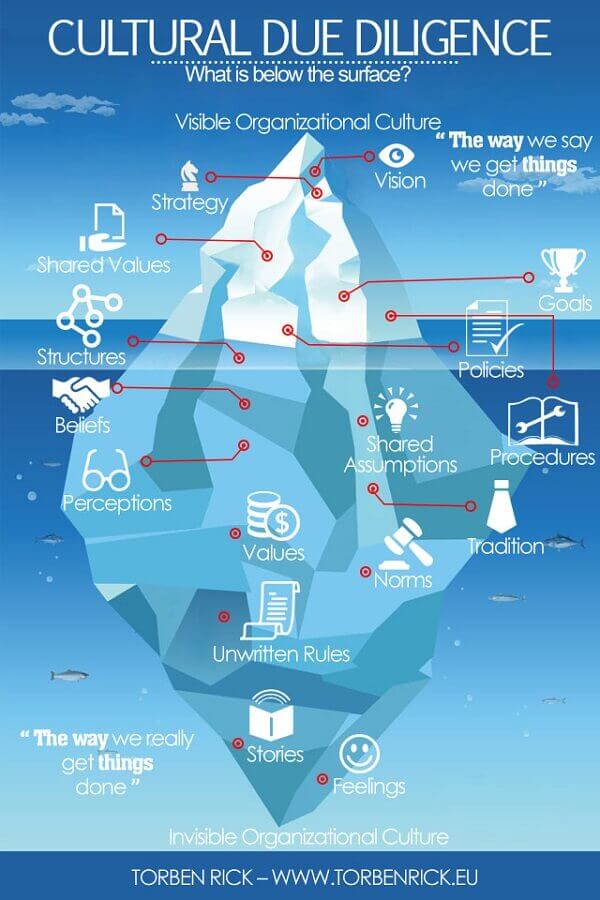

What is below the organizations surface

Cultural due diligence should be integrated into the process early on. It should consists of a cultural assessment that discover areas of similarity and difference that will impact integration efforts and the achievement of strategic objectives.

Understand the cultural dynamics of the acquired organization: How do they operate? How do they develop their talent? How are they motivated to succeed? What’s their executive management decision-making style? etc. etc.

Culture as part of the due diligence process

Between 55 and 77 percent of all mergers fail to deliver on the financial promise announced when the merger was initiated, and they fail for the same two basic reasons:

- Failure to assess the potential impact of attempting to merge and integrate the cultures of the companies involved

- Failure to plan for systemic, systematic and efficient integration of those cultures.

So better include culture as part of the due diligence process and be prepared to address the in-congruences between business units with action.

Short URL & Title:

Organizational cultural due diligence — https://www.torbenrick.eu/t/r/iol

Share it:

If you enjoyed this article, please take 5 seconds to share it on your social network. Thanks!

Nice post as well as nice concept you have shared. Informative and useful info-graphic. After reading this post all my doubts are clear about due diligence and M & A process.

It’s surprising that so many companies still spend a large amount on legal due diligence, financial due diligence and ultimately the purchase price, and too often leave the most important asset in the deal – the organizational culture.