There is a huge difference between competing in a market and disrupting a market. When competing, a company tries to make a similar product in a given market segment, then competes against incumbent products on price or features to gain share and hopefully profits. When disrupting, a company produces a whole new product that creates or changes a market, then dominates share and profits in that segment.

Why do so many established and often well managed companies struggle with disruptive innovation? Many times it is simply because companies have been doing the same things, in the same ways, and for the same reasons for so long, that they struggle with the concept of change.

IBM in the mid 1980’s felt that the future would be much like the past and a result didn’t have to change much. They did not realize how much microcomputers would replace the functions of their bread-and-butter business, the mainframe. The net result was tens of thousands of people were laid off, with the company suffering the first losses in its history.

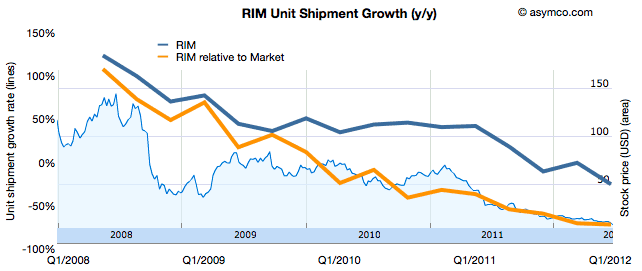

Struggling with disruptive change #1 – RIM

The BlackBerry smartphone maker (RIM) is in deep trouble – but Apple was once in even worse trouble with even less time to fix it. Steve Jobs did bring Apple back from the edge of bankruptcy and today it is one of the most valuable companies in the world, but the speed of innovation is ever-faster. A company that’s fallen behind might never catch up. Will RIM (Blackbarry) catch up?

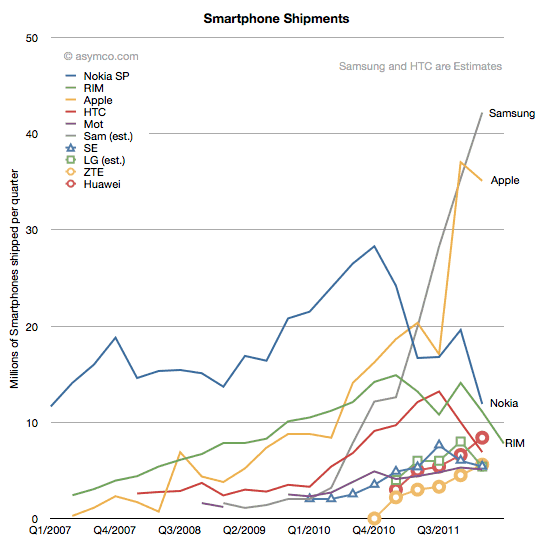

The company had been steadily selling phones up until late 2010 or early 2011, until its shipments began dropping steeply.

The sad fact is that all of this could have been avoided. The company was slow to act in the wake of Apple’s smartphone bombshell back in 2007, believing that consumers would always want a hardware keyboard.

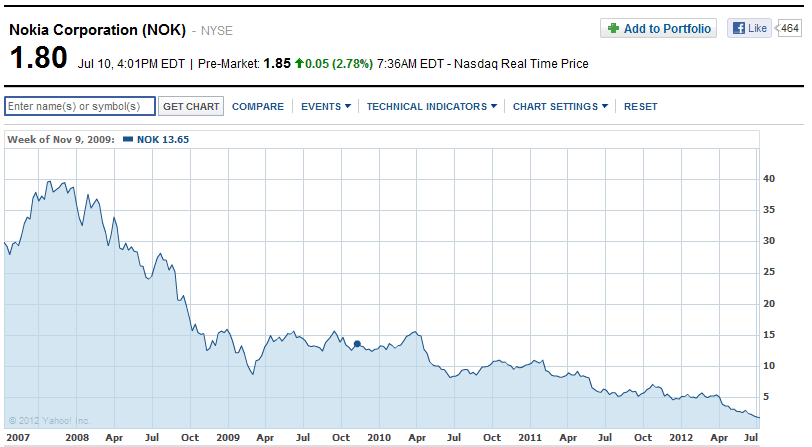

Struggling with disruptive change #2 – Nokia

RIM it’s not the only company in trouble – Nokia is seeing similar drops in shipments.

Nokia phones were once a consumer favorite, but no longer. Other devices, including the Apple iPhone and Samsung Galaxy S smartphone, among many others, have captured consumers’ imagination. Consumers stuck around in support of Nokia for a while, but after they realized that the company wasn’t reacting very adroitly, they left, and they might not come back.

There was a time when they could count on the company to deliver the latest and greatest platform on the market. But over the last several years, it has been slow to react, and when it did offer products, they failed to appeal to the new customer. Now,consumers don’t know if they can trust Nokia’s claims that it will change all that in the coming years. That alone will be a difficult issue for Nokia to overcome.

There are many unflattering comparisons to make regarding Nokia’s current market capitalization. The struggling handset maker’s market cap is now lower than the $8.5 billion Microsoft Corp. paid for IP-telephony company Skype Ltd. last year. Nokia is valued at roughly seven times what Facebook paid for Instagram, and slightly more than half of Apple Inc.’s latest quarterly net profit.

Struggling with disruptive change #3 – Microsoft

Once upon a time, Microsoft dominated the tech industry – indeed, it was the wealthiest corporation in the world. But since 2000, as Apple, Google, and Facebook whizzed by, it has fallen flat in every arena it entered: e-books, music, search, social networking, etc., etc.

The story of Microsoft’s lost decade could serve as a business-school case study on the pitfalls of success. For what began as a lean competition machine led by young visionaries of unparalleled talent has mutated into something bloated and bureaucracy-laden, with an internal culture that unintentionally rewards managers who strangle innovative ideas that might threaten the established order of things.

They used to point their finger at IBM and laugh – Now they’ve become the thing they despised – Bill Hill, a former Microsoft manager

Microsoft have now announced the Surface tablet. It seems nice. But in making the Surface, Microsoft played it safe and chose to compete, not disrupt.

The Microsoft iPad competes with ultra-thin notebooks and full blown PCs with a traditional keyboard and desktop OS, it competes against the Apple iPad, Android tablets, Amazon’s Kindles etc.

In choosing to compete, Microsoft blew it’s chance to create a stand-out tablet device that could challenge the iPad. And it’s a little too late.

Struggling with disruptive change #4 – Barnes & Noble

Brick-and-mortar book stores are in serious trouble

When it no longer makes sense to run a chain of physical book stores, Barnes & Noble will likely be left with its Nook business and online book sales. Unfortunately for Barnes & Noble, the Nook may not be enough to keep the company afloat, but could be an attractive asset for large technology companies to purchase.

Will Barnes & Noble be the next Borders?

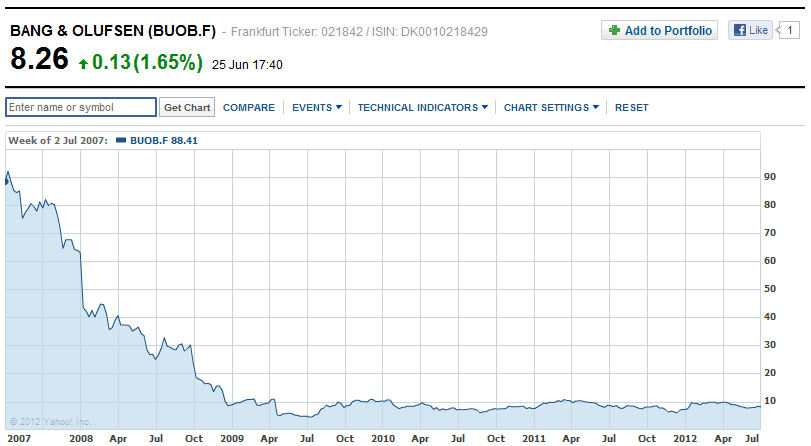

Struggling with disruptive change #5 – B&O

While the Danish company pursued its own cult of design, others like Apple formulated a new aesthetic that took into account the graphical user interface and Moore’s law. As the iPod and iTunes took off, conversation-piece home-entertainment objects seemed less and less relevant. It turned out that the sound system of tomorrow wasn’t an elegant $5,000 device that gave you instant access to six CDs; it was a $400 gadget that allowed you to slip thousands of songs into your hip pocket.

In the midst of this consumer electronics upheaval, Bang & Olufsen remained adamantly, diligently, and somewhat endearingly committed to following its own path.

But in 2008, the global financial crisis confronted B&O with perhaps its gravest existential threat since Nazi sympathizers blew up its factory in 1945. Between 2008 and 2009, annual revenue plunged from $853 million to $528 million, and its stock price plummeted from $52 to $8.50. The manufacturer could no longer ignore the urgent realities of the present. It was forced to shed product lines, shuffle CEOs, and lay off hundreds of workers.

Struggling with disruptive change #6 – Kodak

In the 20th century, Kodak was truly one of the world’s powerhouses. Until the 1990s it was regularly rated one of the world’s five most valuable brands. Kodak is Bankrupt

Digital photography took off and Kodak wasn’t ready for it. Was Kodak blind to disruptive changes in the marketplace? And why didn’t Kodak invent Instagram, or an app like it?

Struggling with disruptive change #7 – Blockbuster

In Blockbuster’s case, it was streaming service and mail-order movie service that possessed the foresight that Blockbuster lacked. And while its competitors steadily gained market share through novel and innovative approaches, Blockbuster remained defiantly steadfast in its profound reliance on a brick-and-mortar business.

Struggling with disruptive change #8 – Cisco

Cisco spent $590 million in 2009 to buy into the camera business – they bought Flip, the maker of the popular Flip Video camcorders, from Pure Digital. Two years later Cisco had to shut down the business unit.

Struggling with disruptive change #9 – Hewlett-Packard and Dell

Once synonymous with PCs, Hewlett Packard and Dell are now struggling to keep up with the software-driven shift to integrated, differentiated systems.

Struggling with disruptive change #10 – Neckermann

With a string of high-profile bankruptcies and thousands of layoffs, the German retail sector is in upheaval as it struggles with the challenges of changing customer trends and online shopping. Now, the iconic mail-order chain Neckermann, with more than 2,500 employees, filed for insolvency.

Struggling with disruptive change #11 – Schlecker

Germany’s biggest drugstore chain (high-street chemist) – Schlecker – has filed for bankruptcy. A company with seven thousand shops and thirty thousand employees.

Short URL & title:

11 companies that are struggling with disruptive change — http://www.torbenrick.eu/t/r/mur

Share it:

If you enjoyed this article, please take 5 seconds to share it on your social network. Thanks!

Very thought-provoking. While Borders was a sad loss, not sure we could cope these days without Amazon – or mail order dvds, for that matter ?

torbenrick This is why large companies favour growth by acquisition. It’s almost certainly cheaper to let the market’s weeding-out process reveal the successful innovations, rather than to risk money on your own speculative R&D. But the trick is to avoid absorbing and stifling what you’ve bought. Often this boils down to an X- vs Y-management cultural clash, which can easily end in tears.

Great article…some irony around Google’s Picasa App…it “was” a Kodak funded lab project when I was first introduced to it. I was told by a member of the team that they could not find traction with internal Kodak teams…I am reminded that corporate survival is “not” manditory.

Very inspriring ‘food for thought’. Much appreciated.